Ikerd company applies manufacturing overhead – Ikerd Company’s application of manufacturing overhead is a crucial aspect of its operations, directly impacting product costing and profitability. This article delves into the intricacies of manufacturing overhead allocation, exploring its methods, advantages, and implications. We will also examine techniques for controlling and analyzing overhead costs, providing a comprehensive understanding of this fundamental business concept.

The second paragraph provides a detailed overview of manufacturing overhead, including its definition, types, and the rationale behind its allocation to products.

Ikerd Company’s Manufacturing Overhead Application

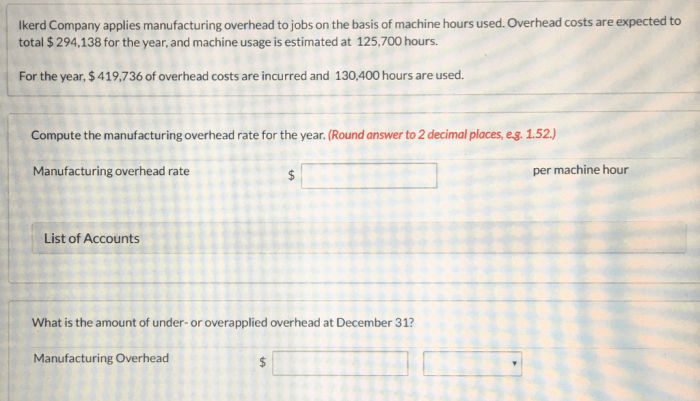

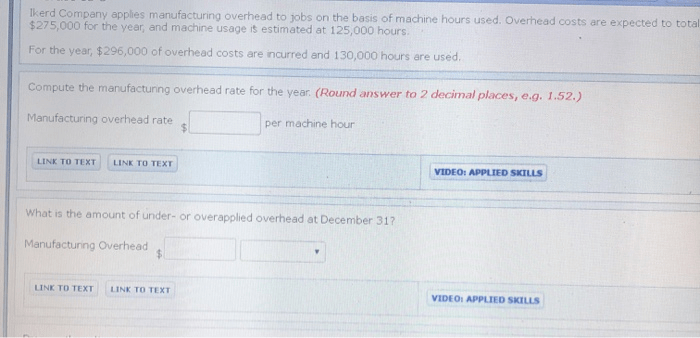

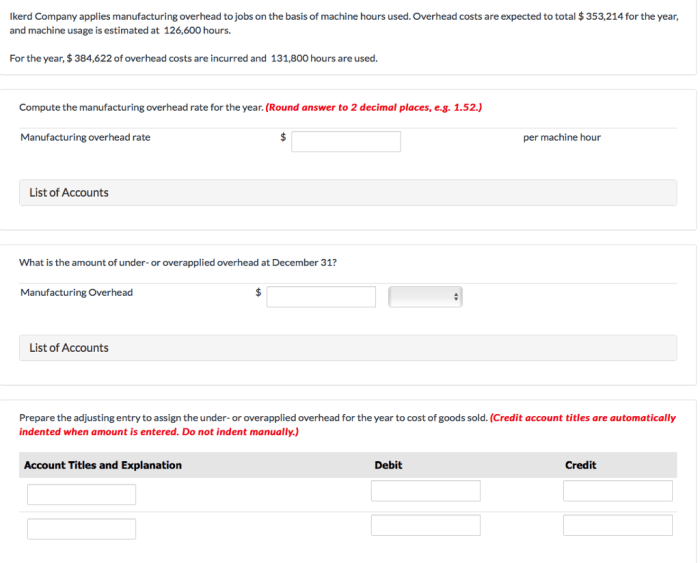

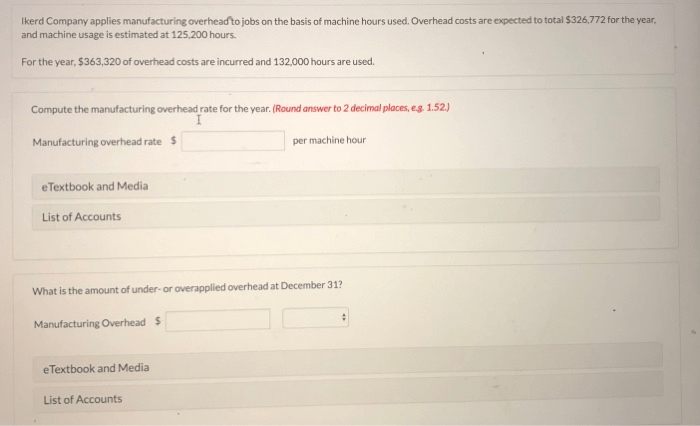

Manufacturing overhead refers to indirect costs incurred during production that cannot be directly attributed to specific units of output. Ikerd Company applies manufacturing overhead based on a predetermined overhead rate, calculated as total estimated overhead costs divided by the estimated activity level (e.g.,

direct labor hours or machine hours).

Examples of manufacturing overhead costs incurred by Ikerd Company include:

- Indirect labor wages

- Factory utilities

- Factory rent

- Depreciation on factory equipment

- Factory supplies

Methods for Allocating Manufacturing Overhead

Various methods can be used to allocate manufacturing overhead costs to units of production. Common methods include:

Direct Labor Hours

This method allocates overhead based on the number of direct labor hours worked on each unit. It is simple to apply but may not accurately reflect the actual consumption of overhead resources.

Machine Hours

This method allocates overhead based on the number of machine hours used to produce each unit. It is more accurate than direct labor hours when machines are a significant cost driver.

Activity-Based Costing (ABC)

ABC allocates overhead based on multiple cost drivers that more accurately reflect the actual consumption of overhead resources. It is the most accurate method but also the most complex and time-consuming to implement.

Impact of Manufacturing Overhead on Product Costing

Manufacturing overhead is incorporated into product costing through the calculation of unit product cost. Unit product cost is determined by dividing the total manufacturing costs (including direct materials, direct labor, and manufacturing overhead) by the number of units produced.

For example, if Ikerd Company incurs $100,000 in direct materials, $50,000 in direct labor, and $25,000 in manufacturing overhead to produce 10,000 units, the unit product cost would be $17.50 ($100,000 + $50,000 + $25,000) / 10,000.

Over- or Underapplied Manufacturing Overhead, Ikerd company applies manufacturing overhead

Overapplied manufacturing overhead occurs when the actual overhead costs incurred are less than the overhead costs applied to production. Underapplied manufacturing overhead occurs when the actual overhead costs incurred are greater than the overhead costs applied to production.

Over- or underapplied manufacturing overhead can result from errors in estimating overhead costs or activity levels. It can also be caused by changes in production volume or product mix.

Control and Analysis of Manufacturing Overhead

Techniques for controlling and analyzing manufacturing overhead include:

- Establishing realistic overhead budgets

- Monitoring actual overhead costs against budgeted amounts

- Investigating variances between actual and budgeted overhead costs

- Implementing cost-saving measures to reduce overhead costs

Key performance indicators (KPIs) for monitoring manufacturing overhead include:

- Overhead cost per unit

- Overhead absorption rate

- Overhead variance

Common Queries: Ikerd Company Applies Manufacturing Overhead

What are the common methods used to allocate manufacturing overhead?

Direct labor hours, machine hours, and activity-based costing are widely used methods for allocating manufacturing overhead.

How does manufacturing overhead impact product costing?

Manufacturing overhead is incorporated into product costing through the calculation of unit product cost, which includes direct materials, direct labor, and a portion of overhead costs.

What are the consequences of over- or underapplied manufacturing overhead?

Overapplied overhead can lead to an overstatement of product costs and net income, while underapplied overhead can result in an understatement of product costs and net income.